Source: www.rucriminal.info

The authorities of Hamburg commented rather evasively on the Forbes news about the confiscation of Alisher Usmanov's yacht. They reported that there was no confiscation, as such, but the ship would not be allowed to sail anywhere. The $600 million Dilbar yacht is currently undergoing scheduled repairs at the docks in Hamburg. The source of the VChK-OGPU telegram channel believes that the European authorities will have big problems with Usmanov's assets. “His yacht, plane, three houses in Germany, etc. are issued to offshore companies, and even if you “shovel” all the chains of companies whose data has been “leaked”, you will not find a direct connection with Usmanov and his companies. Officially, Usmanov rents houses, a yacht and a plane from these offshore companies, he has all the necessary documents. All such issues will be resolved in the courts and I doubt that they will be easy for the European authorities.”

As for the three houses on the shores of the picturesque lake Tegernsee in Bavaria, interesting details are revealed with them. As it turned out, Svetlana Medvedeva, the wife of Dmitry Medvedev, was visiting one of these houses. Why does Usmanov need three houses that are not neighboring?

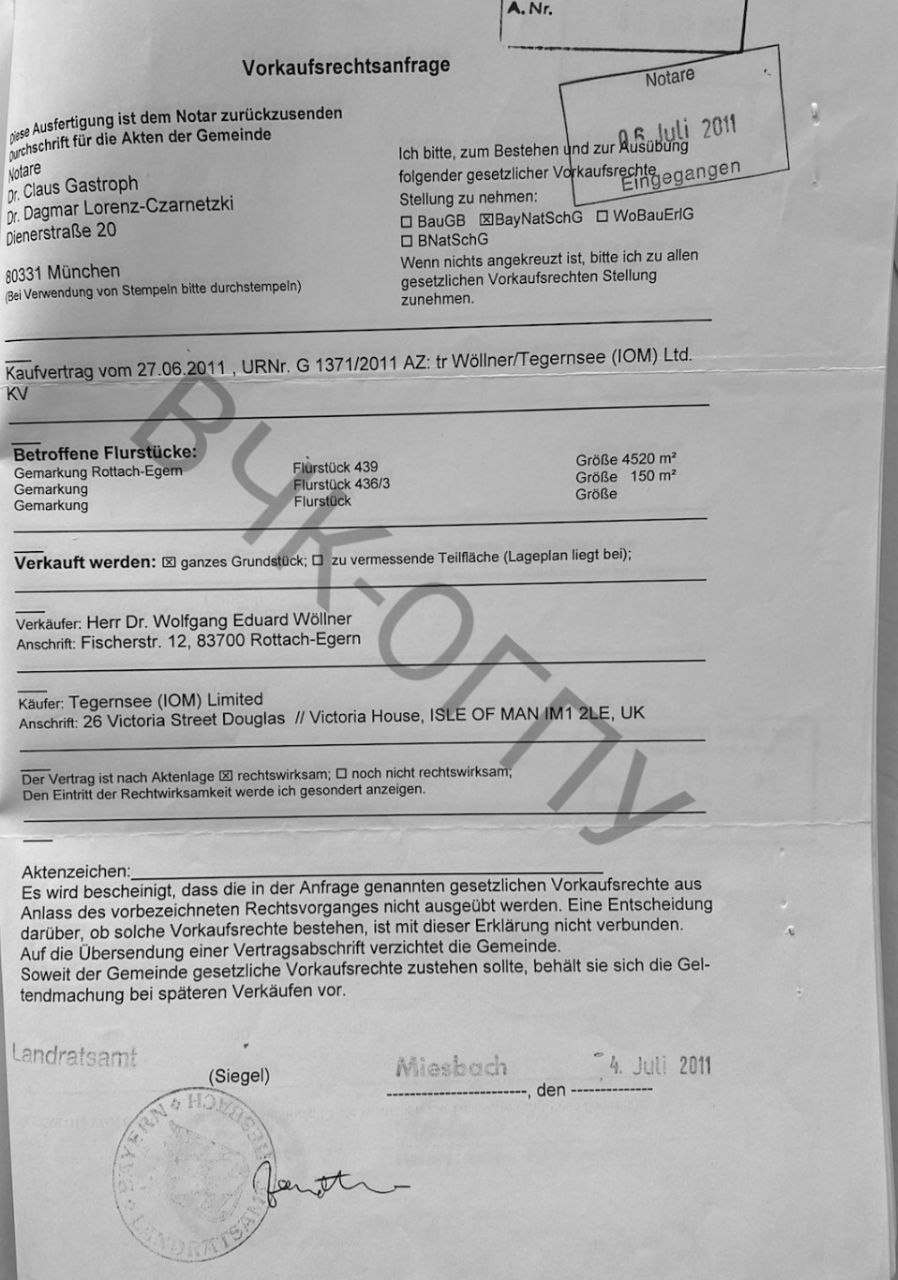

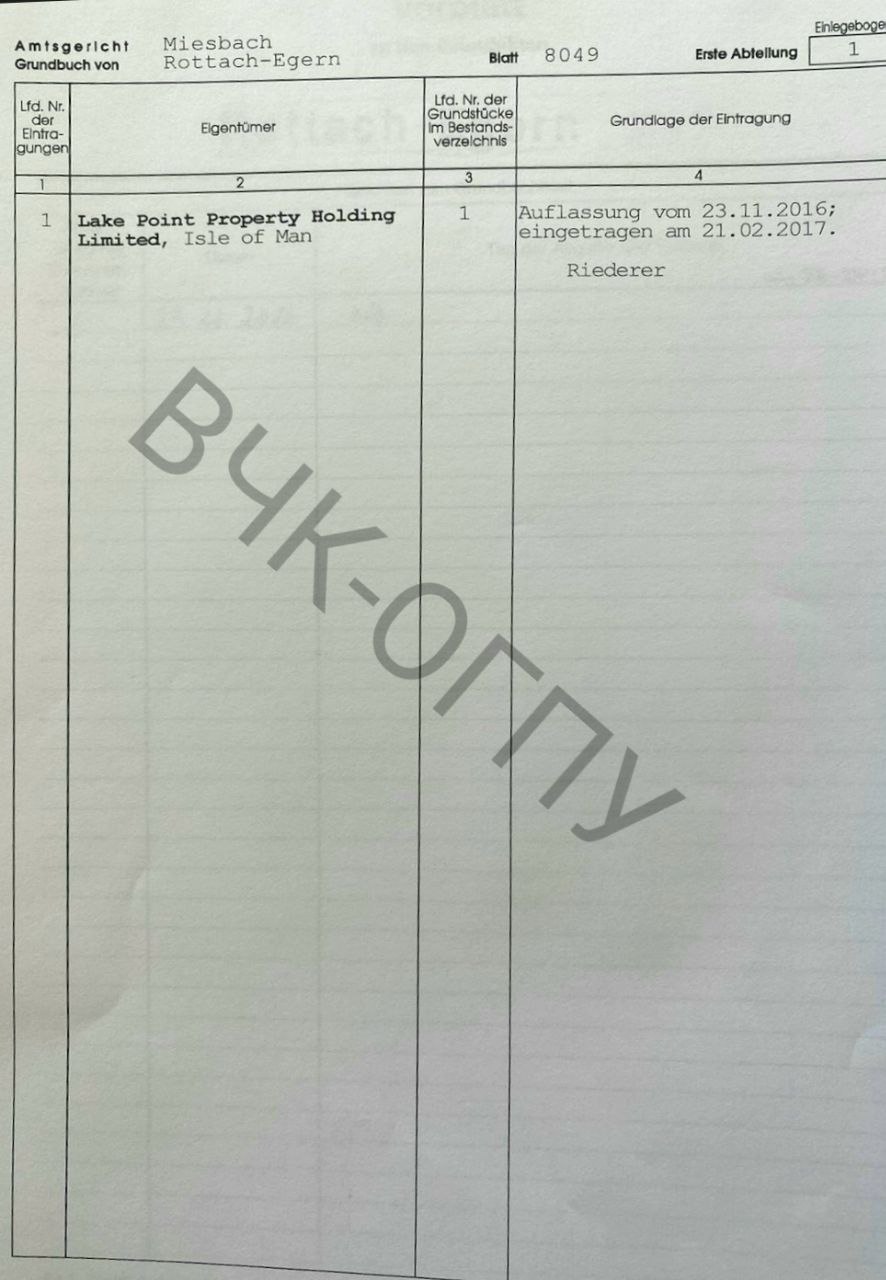

Everything is simple. Villa 1: Usmanov has owned a stately villa with a double balcony and green shutters on Fischerstrasse since 2011 right on the lake, complemented by a boathouse. He acquired it through Tegernsee (IOM) Limited (Isle of Man) and completely rebuilt it for himself, investing a total of 20 million euros. This is the house of Usmanov himself

Villa 2: According to the neighbors of the oligarch, there are only 7-8 bodyguards with him, as well as drivers, servants, cooks, etc. etc. Usmanov did not want to live with him in the same household and bought a villa nearby (on Forellenstrasse) for servants for 6.5 million euros. The house is to be demolished and replaced with a new building. However, Usmanov limited himself to repairs.

Villa 3: Usmanov has relatives, friends after all. He also did not really want to place them under the same roof with him. But you can't send it to the servants either. So he bought another villa on Gangoferstrasse. However, there is reason to believe that in reality the villa is intended for only one very important guest. It was in this villa that Svetlana Medvedeva was seen.

By the way, one of the points of events, due to which sanctions were applied against Usmanov, was an article by Dmitry Medvedev. The paragraph reads: “When Mr. Usmanov took control of the daily newspaper Kommersant, editorial freedom was limited and the paper took a decidedly pro-Kremlin stance. Mr. Usmanov's Kommersant published an anti-Ukrainian propaganda article by Dmitry Medvedev in which the former Russian president argued that it was pointless to negotiate with the current Ukrainian authorities, which he believed were under direct foreign control. Therefore, he actively supported the policy of the Russian government to destabilize Ukraine.”

Usmanov's estate in Germany was also remembered by the miners, who believe that they became a victim of Usmanov.

The miners indicate that they lost their shares in the GOK during a forced buyout, which was made by Usmanov's structures at prices far from market ones. The assessment was carried out by Gorislavtsev & Co. Estimation”, which proceeded from the fact that the official revenue of the Mining and Processing Plant amounted to less than $1 billion. However, according to the applicants, in reality, the proceeds were underestimated by at least three times. For the purpose of tax optimization, products were sold at discounted prices to Usmanov's offshore companies (BGMT and FMC ltd.), and they already sold them at market prices. As a result, GOK's real revenue was at least $3 billion. “Recently, a package of documents formed on the territory of English law by former employees of A.B. Usmanov (including the Honorable Lord David Owen), who unconditionally and fully confirm the above information, namely: the concentration of profits of OJSC Lebedinsky GOK in the offshore (Article 199 of the Criminal Code of the Russian Federation) through which all export deliveries of the products of the enterprise OJSC " Lebedinsky GOK," the miners said. In Russia, they despaired of getting justice. Moreover, representatives of Metalloinvest called the miners "criminals" and promised to "pursue" them. As a result, the miners turned to US Attorney General Merrick Brian Garland. This treatment of banknotes is published by Rucriminal.info.

"Dear Attorney General Garland,

We, the Russian miners of the Lebedinsky Mining and Processing Plant, understand that your area of responsibility includes fighting crime, injustice, fraud and money laundering in the United States.

The month of the tragedy of Ukraine and rapidly collapsing Russia has ended. ..We were informed that our most generous patron (according to the Sunday Times of 05/21/21) with a British passport made an agreement with very influential American guys from the world of finance 4 years ago when he left Russia. The OFAC 15 General License is a clear confirmation of this information…

Today we ask you to take into account: the subject of our appeal is constantly located on the territory and Germany, Switzerland, Sardinia, London, and recently conducted his business from Bavaria, not far from Munich. His firms (Metalloinvest Trading AG, FMC ltd.) engaged in money laundering using large scale tax evasion procedures.

Violation of the property rights of minority shareholders as a result of large-scale fraud in the forced buyout of Lebedinsky GOK shares:

Mr. Usmanov’s Metalloinvest LLC (formerly GAZMETALL LLC) exercised its rights to force buyout of shares of Minority Shareholders in accordance with the provisions of the RF Law “On Joint Stock Companies”, which were lobbied by Mr. Alisher USMANOV as amendments to the law, in 2006

We have strong evidence that these procedures were flawed in both process and outcome.

The Lebedinsky mine is now owned by Metalloinvest Management Company LLC (Metalloinvest).

Clause 4 of Article 84.8 of Federal Law No. 208-FZ (Federal Law “On Joint Stock Companies”): Securities are redeemed at a price not lower than the market value of the securities being redeemed, which must be determined by the appraiser.

By order of Metalloinvest/GAZMETALL, the market value of our shares was determined by Gorislavtsev & Co. Appraisal”, very famous in Russia for unscrupulous appraisals with a reputation as a “seal seller”.

Gorislavtsev & Co's valuation was fundamentally flawed and materially inaccurate in estimating the true market value that should have been attributed to the minority shareholdings. All production capacities were valued well below the actual price (determined at the same time by the London office of Deutsche Bank for the IPO) and were prepared on the basis of clearly limited and materially incorrect data that completely ignored the transfer pricing trading schemes implemented by Metalloinvest and affiliates in relation to the sale of iron ore products.

When we submitted to Alisher Usmanov our modest plea for fair play and handed over to him the documents prepared by his offshore managers such as business consultant in the UK Mr. . and FMC ltd.), we received a promise of a speedy and fair settlement of the forced buyout issue with a clear fraudulent action: an underestimation of the capitalization of our enterprise / shares. He lied!

At the same time, as it turned out, Usmanov lured us beyond the 6-month limitation period to file a claim for the return of confiscated property. Having received a completely corrupt cover from the highest Russian authorities, the UK resident received absolute immunity in Russia without the risks associated with the purely criminal aspects of our petition: tax evasion on an especially large scale and fraud against minority shareholders. The fraud is clearly visible in the documents attached to this letter: while Lebedinsky GOK's officially reported revenue for the fiscal year ended December 31, 2007 was less than $1 billion, Usmanov's offshore FMC revenue from the resale of iron ore and steel exceeded $3 billion. dollars.

We asked an Ilaw lawyer in London to review our papers to see if we could take legal action against the UK's most generous philanthropist.

Barrister QC, in collaboration with Ilaw's attorney, pointed out the definitely fraudulent activities, two assessments of the mining operation:

- the first estimate, as indicated above, was prepared in the absence of real profits for Lebedinsky GOK due to the unreported income of its offshore subsidiary;

- the second estimate was prepared by Deutsche Bank London, taking into account all cash flows, including offshore income, to estimate the real capitalization intended for an IPO on the London Stock Exchange.

From 2008 to 2021, minority shareholders of LGOK filed lawsuits and petitions in various Russian courts and government agencies regarding the buyout process and how the “fair market price” was set in the valuation report, pointing to clear signs of a criminal article – fraud of art. 159 part 4 of the Criminal Code of the Russian Federation.

Since 2011, we have also conducted a comprehensive legal and factual investigation into the 2007 buyout. As part of this process, we commissioned two completely independent appraisal reports conducted by Khanzhonkov, the Institute of Private Experts, the Belgorod Regional Forensic Expertise Center and the Expert Council of the Interregional Union of Appraisers, Rostov, which were ignored by the Russian arbitration due to the corrupt court system. These independent estimates confirm that the price paid for their shares must have been significantly higher, namely 3 times higher than the price paid; the fair market price of the shares at the official buyback date was RUB 23,477.66 (equivalent to $939) per share.

In 2014, we obtained available information from documents filed by Metalloinvest with the London Stock Exchange, as well as from the prospectus “Cash Offer from Ferrous Metal Company Limited For Europe Steel Plc” (“Cash Offer Offer”). The two reports and the Cash Offer demonstrate to any independent observer that Metalloinvest and its affiliates have engaged in aggressive tax avoidance strategies based on widely known and discredited transfer pricing schemes. ….

We then reviewed and analyzed in detail the investigation published by Alexei Navalny; please see the details of this investigation at https://www.youtube.com/watch?v=sM8_EvVD4iw. The investigation clarifies that Metalloinvest used highly dubious transfer pricing trading schemes in relation to the sale of iron ore. This is strong evidence that the value of Lebedinsky GOK was significantly underestimated prior to the buyout.

Thus, in addition to the fact that Mr. Usmanov gained control over the largest iron ore producer in Europe, OAO Lebedinsky Mining and Processing Plant (Lebedinsky GOK), at the price of a small London apartment, through a “greenmail” (gas blackmail) with the help of Gazprom was grossly and cynically violated the key principle of compulsory repurchase - "the market price of an asset". It's called a scam!

In view of the foregoing, we, as minority shareholders of Lebedinsky GOK, are taking legal action in the UK and the EU or the US against Metalloinvest and its controlling and affiliated entities and individuals (in particular those who currently reside in British and Swiss jurisdictions) .

Three weeks ago we received a document from Swiss traders that clearly shows the involvement of Deutsche Bank in the financial affairs of Usmanov's firms operating in the EU, US and UK, as the main paying agent and transfer agent.

We understand that Deutsche Bank was invited by Usmanov to represent its speculative operations in the stock markets in a respectable manner, as well as to raise the maximum level of trust and whitewash its reputation. Other financial institutions involved in Mr. Usmanov's financial transactions were also unaware of his criminal history and business habits.

Now we ask you to restore justice and law, which are completely corrupted in Russia by oligarchs and kleptocratic rulers.

As Usmanov's adviser told us, Deutsche Bank conducted a formal valuation of Metalloinvest in 2008, with a thorough review of all production facilities, including OAO Lebedinsky GOK, Oskolsky Electrometallurgical Plant and Mikhailovsky GOK.

Since this is one of the most important documents for the High Court of London, we kindly ask you to make a formal request to Deutsche Bank, London branch for a copy of this report!

Due to the fact that Mr. Usmanov withdrew all assets from his accounts in the US and the EU, hiding "his" property in the accounts of his friends (Mr. Farhad Moshiri, Chief) in order to avoid arrest under sanctions, we kindly ask you to take measures prosecutor's response measures and freeze the amounts in the accounts of Metalloinvest Trading AG the value of our shares until a court decision.

Thomas Gordon

To be continued

Source: www.rucriminal.info