Source: www.rucriminal.info

rucriminal.info accurately predicted the fate of the International Bank of St. Petersburg (IBSP). Back in June, we reported that this bank, controlled by the former senator Sergey Bazhanov, the Central Bank will withdraw the license. This was due to the fact that the main cover of the IBSP, the head of the North-Western Central Administration of the Central Bank, Nadezhda Savinskaya, left the Bank of Russia. And then it turned out that in the bank Bazhanov huge "hole".

And so, this week, the Central Bank announced the revocation of a license from the IBSP. The message from the Bank of Russia states that

IBSP used a risky business model, which resulted in the bank’s balance sheet having “a significant amount of distressed assets, including derivative financial instruments and unconfirmed claims on non-resident companies”. The Central Bank revealed a significant imbalance between the value of the bank’s assets and liabilities, the amount of which exceeded 15.5 billion rubles. About how this “hole” was formed, to whom Bazhanov transferred the money to the credit institution, why the investigators would certainly not pass by the ex-senator, rucriminal.info will tell in the near future. We will also inform you which other bank that was “under the wing” of Savinskaya will also soon lose its license. We will devote the same article to another, more interesting, credit institution.

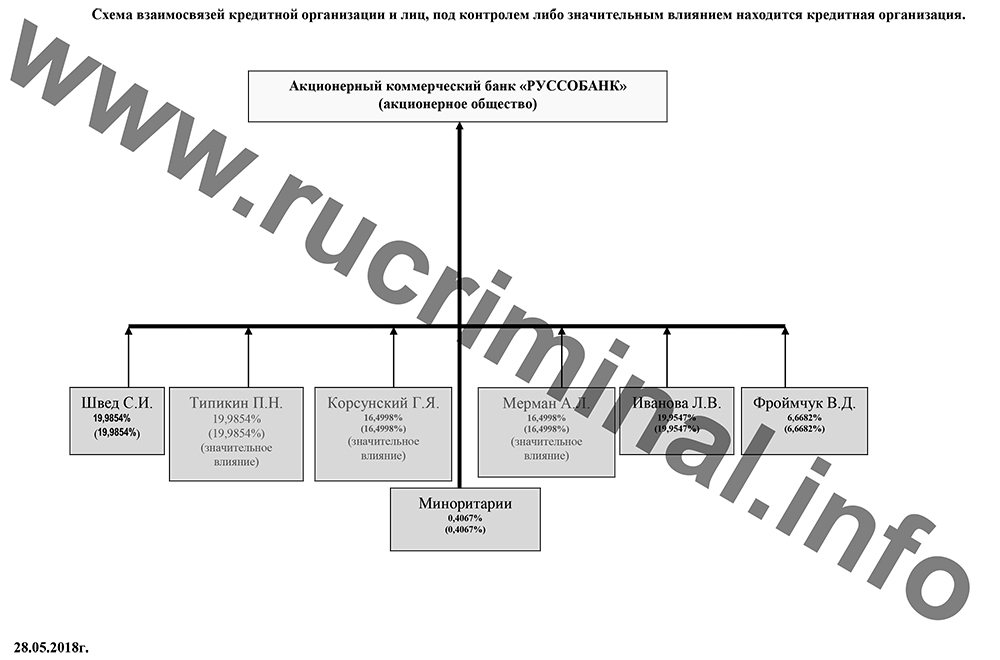

Sources of rucriminal.info in the Central Bank of the Russian Federation, which told at one time about the upcoming revocation of the license from the IBSP, reported serious troubles with Russobank, which are related by kinship with the family of the Moscow Region Governor Andrei Vorobyov. According to our interlocutor, during the last inspection of “Russobank” serious, if not critical, violations were revealed. In particular, a large financial “hole” was revealed. But for her, for the sake of Andrei Vorobyov’s person, they could “close their eyes.” However, the inspectors established gross violations of the Federal Law “On Countering the Legalization (Laundering) of Proceeds from Crime and Financing of Terrorism” dated August 7, 2001 No. 115-ФЗ - the basis of Russian legislation on countering money laundering. In this regard, the Central Bank of the Russian Federation issued a "Russobank" instruction. In the near future, the question of the future fate of the bank will be submitted to a meeting of the Committee on Banking Supervision of the Central Bank of the Russian Federation, which makes decisions about revoking licenses. “There have been attempts from a well-known family to prevent this procedure, but so far the Central Bank leadership is adamant. The probability that Russobank will remain without a license is very high, ”the source believes rucriminal.info.

In September 2017, the wedding took place between the daughter of the Moscow Region Governor Andrei Vorobyev Ekaterina and Mark Tipikin, the son of Pavel Tipikin, the main owner of Russobank. The event was "famous" for the fact that only a wedding cake on it cost almost 1 million rubles.

Later it turned out that, in addition to romance with the governor’s daughter, Mark Tipikin connects with the Vorobiev family and general business. 23-year-old Mark is the owner of three companies, which he headed in 2017. So, in March, Mark became a co-owner of the company “LC“ Estate-leasing ", which deals with venture investments. Other co-owners of the company are the brother of the Moscow Region Governor Maxim Vorobev.

Mark's father Pavel Tipikin was related to the family of the governor of the Moscow region. He met Andrey Vorobyev several years ago at one of the family holidays with his own younger brother Maxim.

Pavel Tipikin is an active member of the Jewish community in Moscow and the business club of the Russian-Jewish Congress (RJC). Tipikin Sr. organizes and conducts weekly lessons for businessmen "Torah in the Bank."

To be continued

Yaroslav Mukhtarov

Source: www.rucriminal.info