Source: www.rucriminal.info

Over Alisher Usmanov, in addition to the already imposed sanctions, the threat of criminal prosecution in the European Union also loomed. As it became known to the Cheka-OGPU, Andrei Ivanov, one of the leaders of the miners of the Lebedinsky GOK, who lost his shares during a forced buyout at a cheap price, which was made by the structures of Alisher Usmanov, was interrogated in the State Criminal Police Department of Germany. As it turns out now, not only the miners were deceived, and the story is subject to investigation in the European Union. Ivanov told the details in an interview with Rucriminal.info and the telegram channel of the Cheka-OGPU.

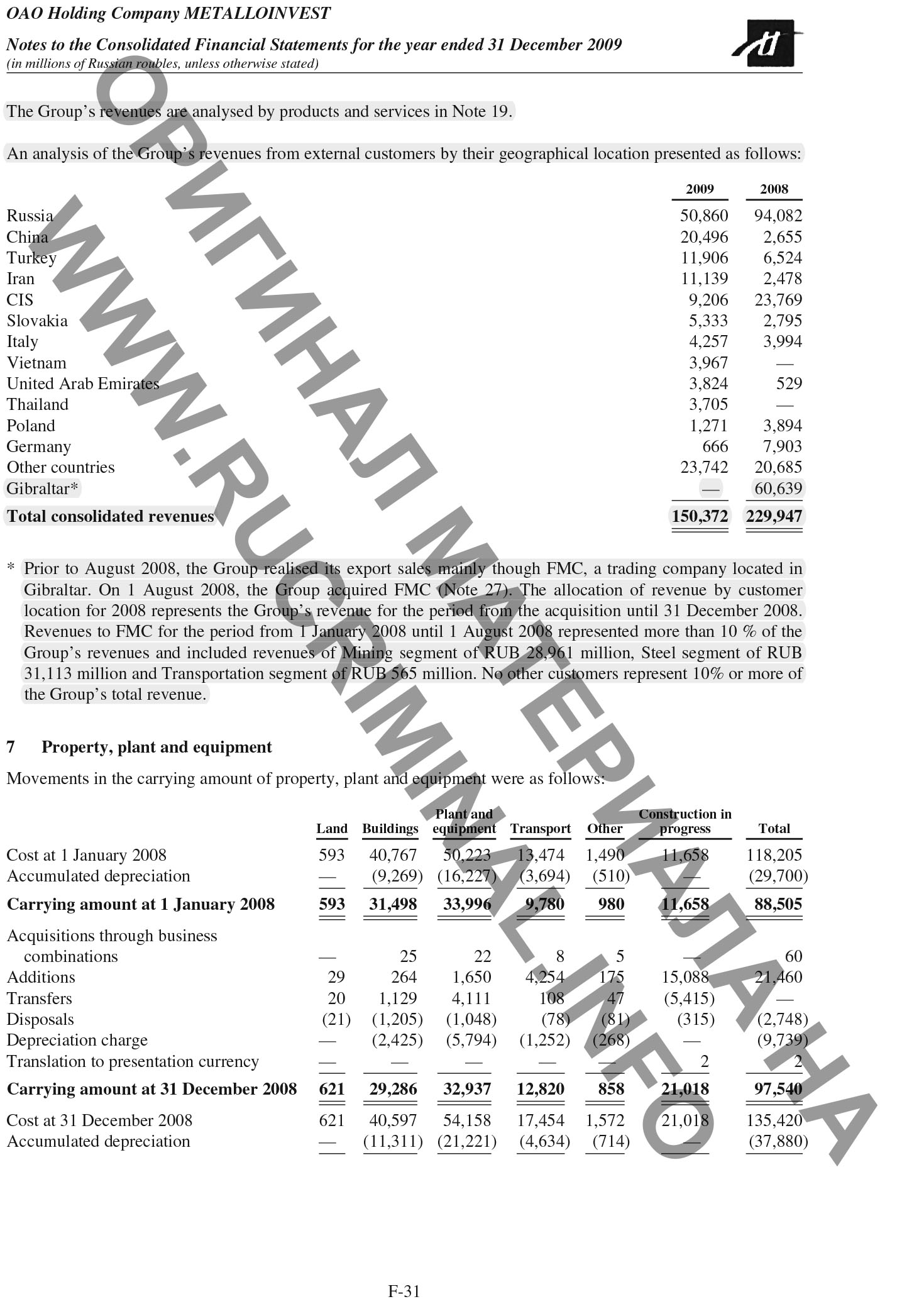

Recall that the miners indicate that they lost their shares in the GOK during a forced buyout, which was made by Usmanov's structures at prices far from market ones. The assessment was carried out by Gorislavtsev & Co. Estimation”, which proceeded from the fact that the official revenue of the Mining and Processing Plant amounted to less than $1 billion. However, according to the applicants, in reality, the proceeds were underestimated by at least three times. For the purpose of tax optimization, products were sold at discounted prices to Usmanov's offshore companies (BGMT and FMC ltd.), and they already sold them at market prices. As a result, GOK's real revenue was at least $3 billion.

“When we arrived at the State Criminal Police Office (Landeskriminalamt) on Friday on the advice of a lawyer, it was exactly 15.00. End of the working day! The officer who received the documents (H. K.) said that he would write down our data in 15 minutes and call on Monday to clarify our application.

However, having heard about whom (!), and what, in question, they began to call Berlin and stayed until the evening (21.30) with us, recording under the protocol.

We continued to work with the translator the following week.

With great curiosity and in more detail, they asked to tell about the Russian practice of hiding the true beneficiaries behind the names of relatives and proxies.

For the former shareholder with a 20% stake, Vasily Anisimov and the one behind him, the officers questioned four times.

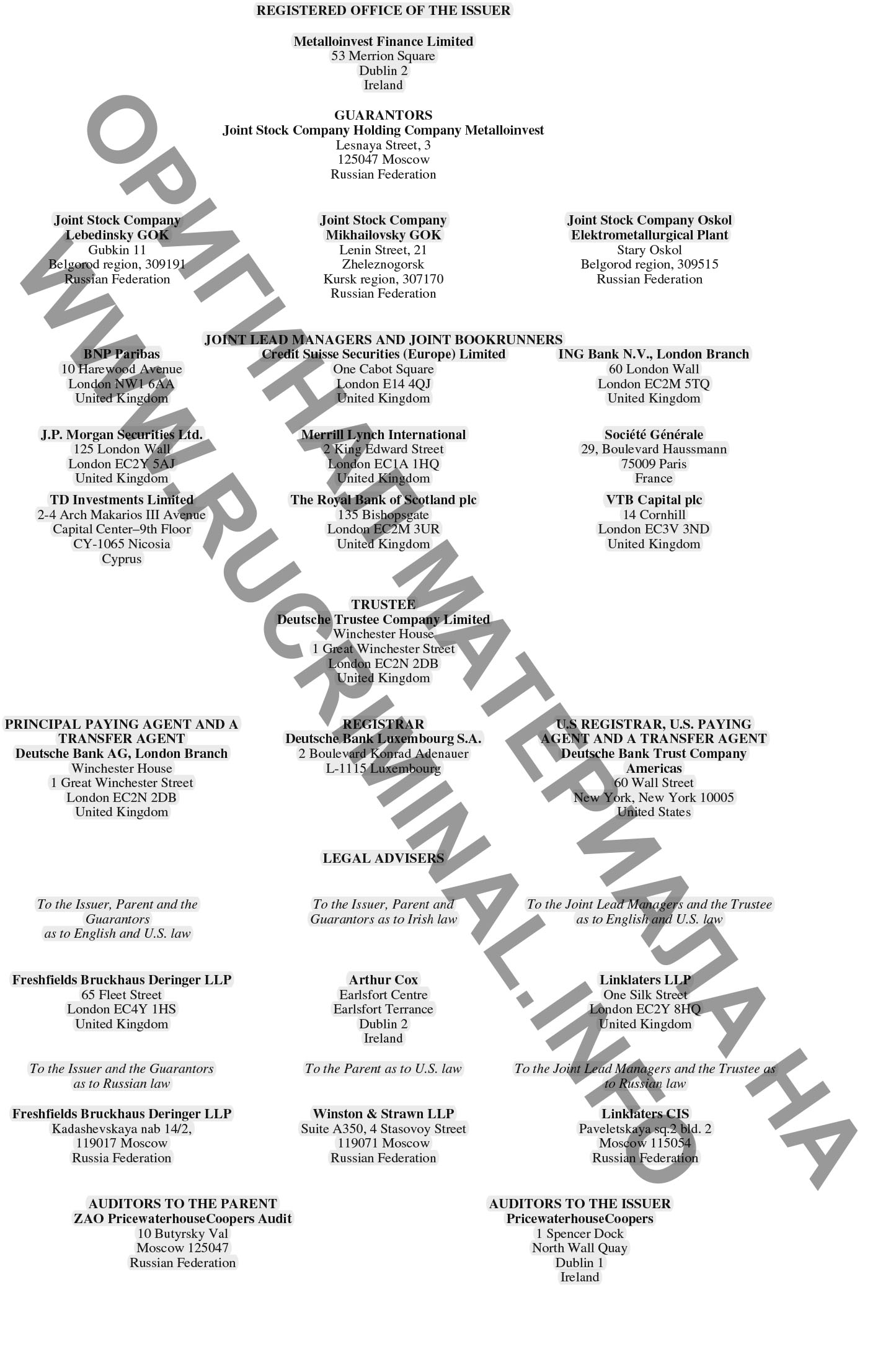

In Metalloinvest's Eurobond prospectus, the officer noted that Alisher Usmanov's company had made traditional inaccuracies with respect to Western bookrunners and Deutsche Bank. Namely, the trading group FMC, Gibraltar is presented as an independent company until August 01, 2008 with a multi-billion dollar revenue. The directors of Metalloinvest, who signed the prospectus, presented the acquisition of the FMC group as a profitable (otherwise, no way!) deal for the purchase of a trader for 17.5 billion rubles, instantly increasing Metalloinvest's revenue by 37 billion rubles. those. by $2 billion between August and the end of the year!

Officer L, at the sight of these official data, asked: "what is the amount by which Vasily Anisimov's friends cheated you?" We showed on the documents - less than 5 million. He was sincerely indignant: "Ich kann die russischen Oligarchen einfach nicht verstehen!" Yeah, we don't know either, to be honest.

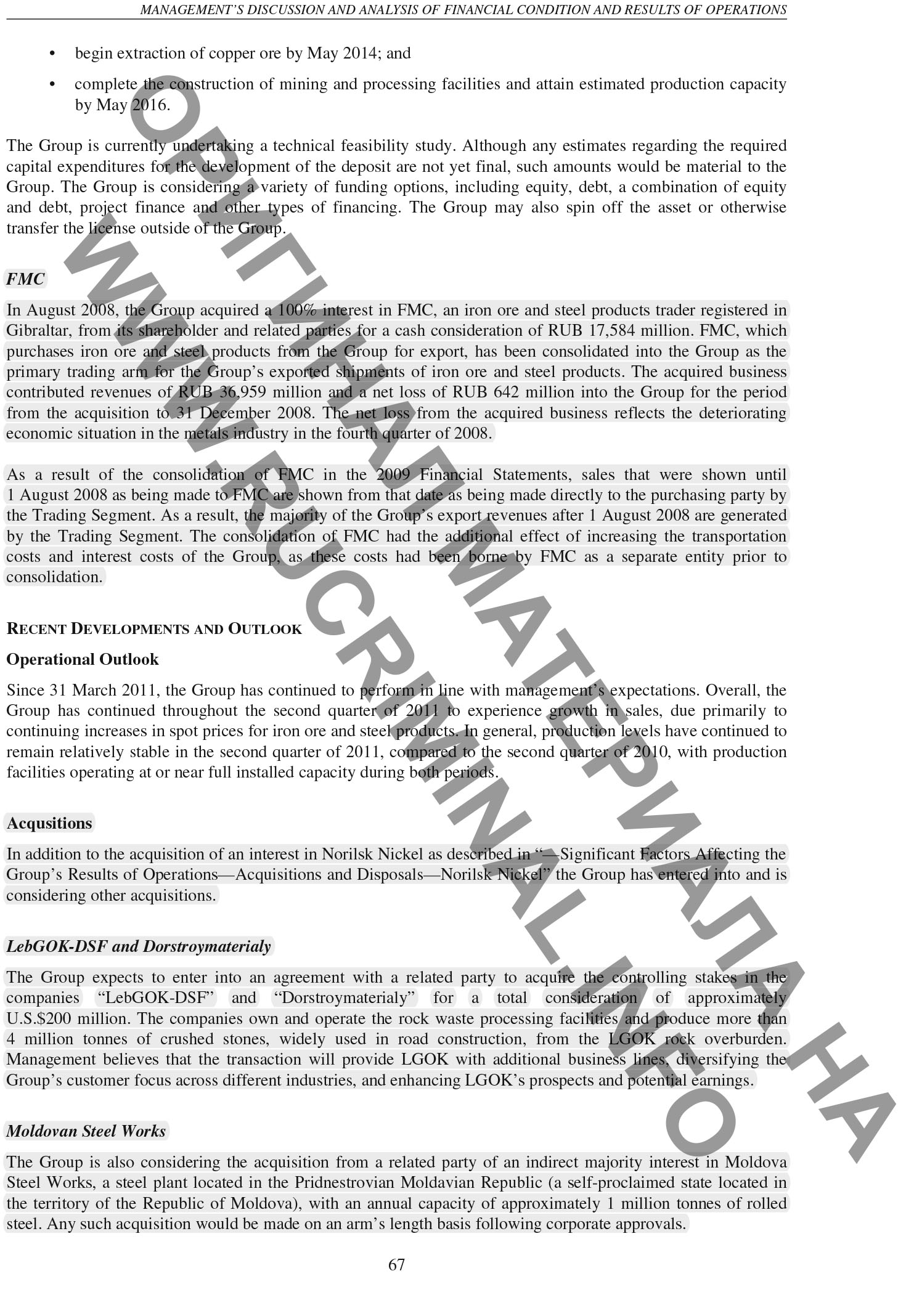

On page 67 of the prospectus, information is provided that could be of interest to the investigating authorities, the prosecutor's office, and even personally the head of the ICR, Alexander Bastrykin. Well, it's just - "if only!", (as Odessa taxi drivers say about their grandmother). If a crow had pecked out a crow's eye, and in Russia corruption would not have become a systemic link between a friend of Vasily Anisimov and Alisher Usmanov.

Since the document was prepared for Western investors, it fully, down to the ruble, discloses the financial flows of offshore and, in black and white, recognition of tax evasion on an especially large scale: "As a result of the consolidation of FMC, in the Financial Statements for 2009, sales that prior to August 1, 2008 were reported as incurred by FMC, from that date shown as effected by the Trading Segment directly to the customer. As a result, most of the Group's (Metalloinvest) export earnings after August 1, 2008 are accounted for by the Trading Segment."

(As a result of the consolidation of FMC in the 2009 Financial Statements, sales that were shown until

1 August 2008 as being made to FMC are shown from that date as being made directly to the purchasing party by

the Trading Segment. As a result, the majority of the Group’s export revenues after 1 August 2008 are generated

by the Trading Segment)

or here, by the way, Usmanov's revelation on page F-31:

“Prior to August 2008, the Group (Metalloinvest) conducted its export sales primarily through the trading company FMC located in Gibraltar. On August 1, 2008, the Group acquired FMC (Note 27). Group's revenue for the period from the date of acquisition to 31 December 2008.

FMC's revenue for the period from January 1, 2008 to August 1, 2008 was over 10% of the Group's (Metalloinvest) revenue and included the Mining segment's revenue of RUB 28,961 million. (1.16 billion dollars), Steel segment in the amount of 31,113 million rubles. (1.25 billion dollars) and the Transport segment in the amount of 565 million rub. No other customers represent 10% or more of the Group's total income.

Prior to August 2008, the Group realized its export sales mainly though FMC, a trading company located in

Gibraltar. On 1 August 2008, the Group acquired FMC (Note 27). The allocation of revenue by customer

location for 2008 represents the Group's revenue for the period from the acquisition until 31 December 2008.

Revenues to FMC for the period from 1 January 2008 until 1 August 2008 represented more than 10% of the

Group’s revenues and included revenues of Mining segment of RUB 28,961 million, Steel segment of RUB

31,113 million and Transportation segment of RUB 565 million. No other customers represent 10% or more of

the Group's total revenue.

Following the ingenious logic of the efficient Ivan Strashinsky, who in February announced to the whole world that the FMC trade margin did not exceed 7% of the export price / revenue of Metalloinvest, it turns out that $ 4.5 billion (in 2008) in the offshore account is only 7% of the company's exports! You definitely do not want to shout - "where is the money, Zin?!".

But seriously, it is terribly disgustingly unpleasant to watch the attempts of Russian law enforcement officers to hide their anti-motivation to look at the crime of the company of Vasily Anisimov and Alisher Usmanov, really sorted into pieces, when they refer to the prejudice.

Goosebumps nice to see how the German officers of honor! 6.5 hours in a row, without a coffee break, and all this after hours, without personal interest! However, they are obviously very personally interested in a healthy society in their country, judging by the communication and determination to do their job first! Faith in humanity has returned to us!”

Thomas Gordon

To be continued

Source: www.rucriminal.info