Source: www.rucriminal.info

rucriminal.info he finished a series of articles about the unprecedented PR activity of Kenes Rakishev in Kazakhstan, Ukraine, Russia and Europe. He pays for dozens of positive materials about himself, about the companies where he is the owner. In the materials he bought, Rakisheva is called a successful venture investor, in fact, a financial genius from Kazakhstan. This is done both to create a positive opinion in the business community and for other purposes. First of all, the" orders "are designed for the" top " of Kazakhstan, the closest circle of President Nursultan Nazarbayev, whose funds are actually invested by Rakishev. In the new series of publications, we will talk about the investment "achievements" of the businessman. As Rakishev invested the money of his senior partners in a Frank fake project and is still trying to pass it off as successful. At the same time, the price of the company's shares fell from $ 1,000 to $ 10, and the structure itself was overgrown with losses of hundreds of millions of dollars.

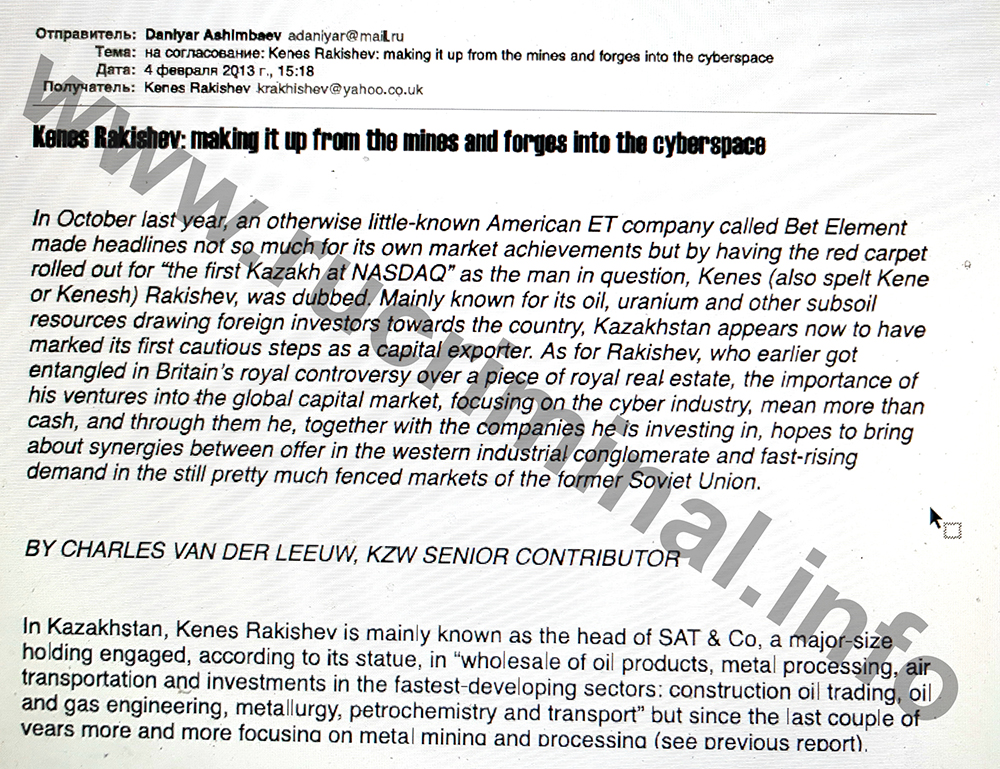

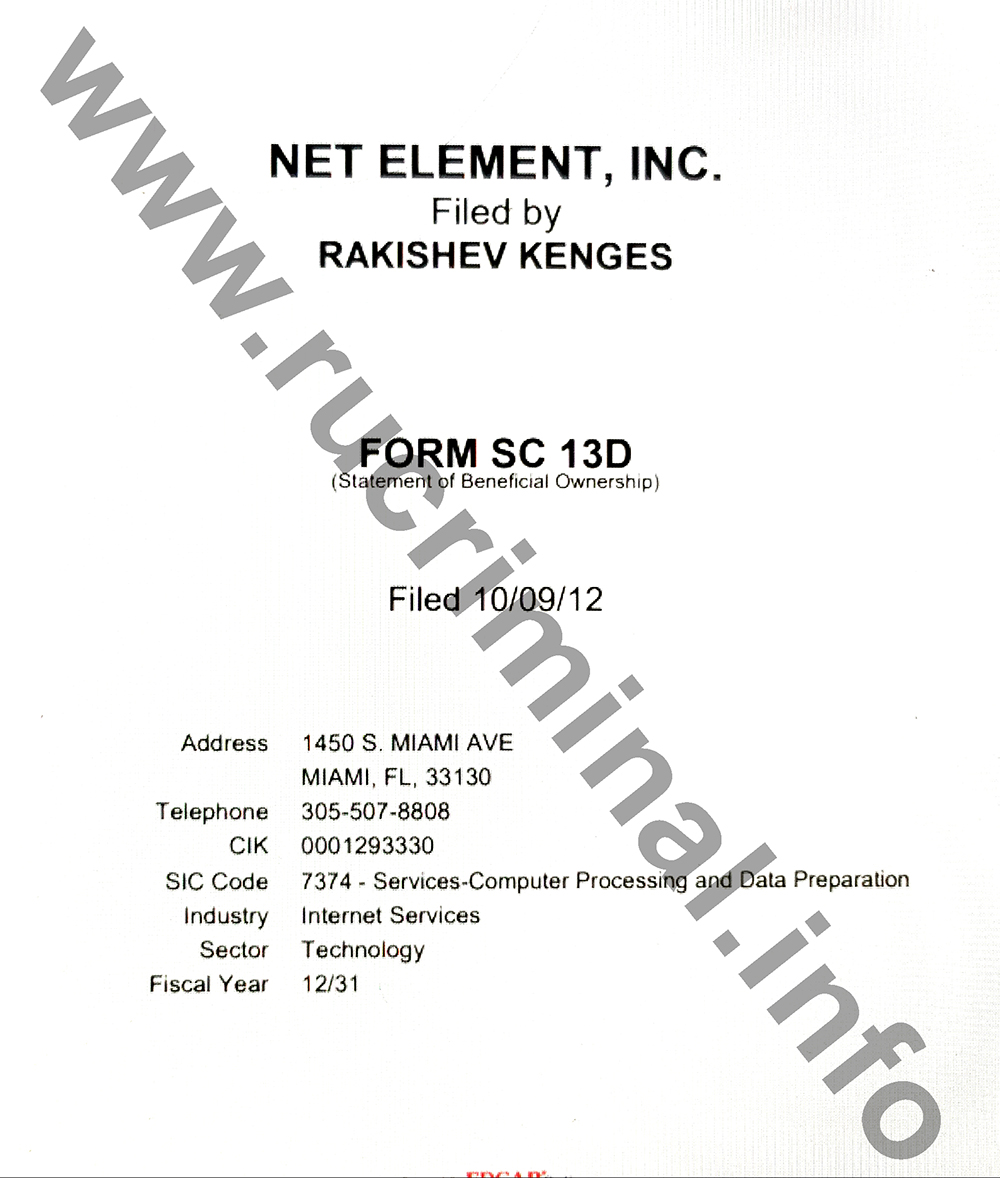

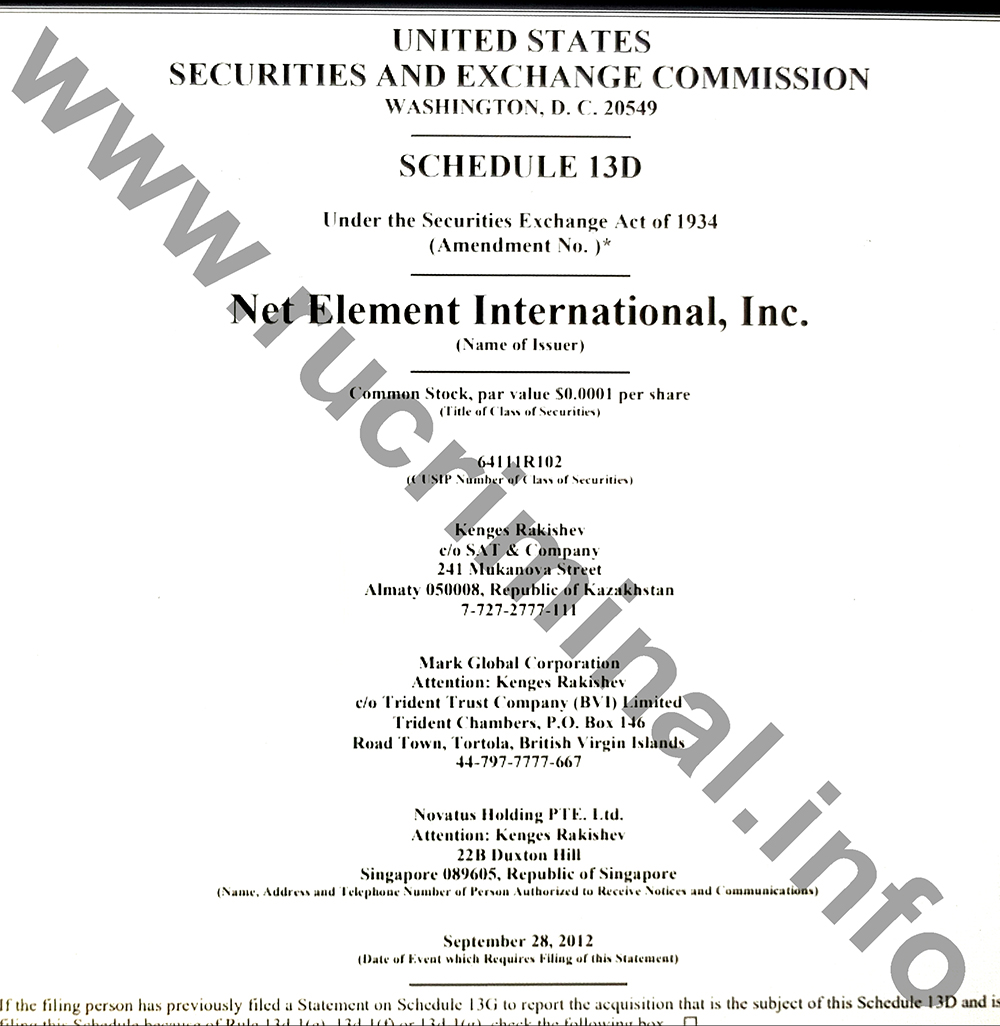

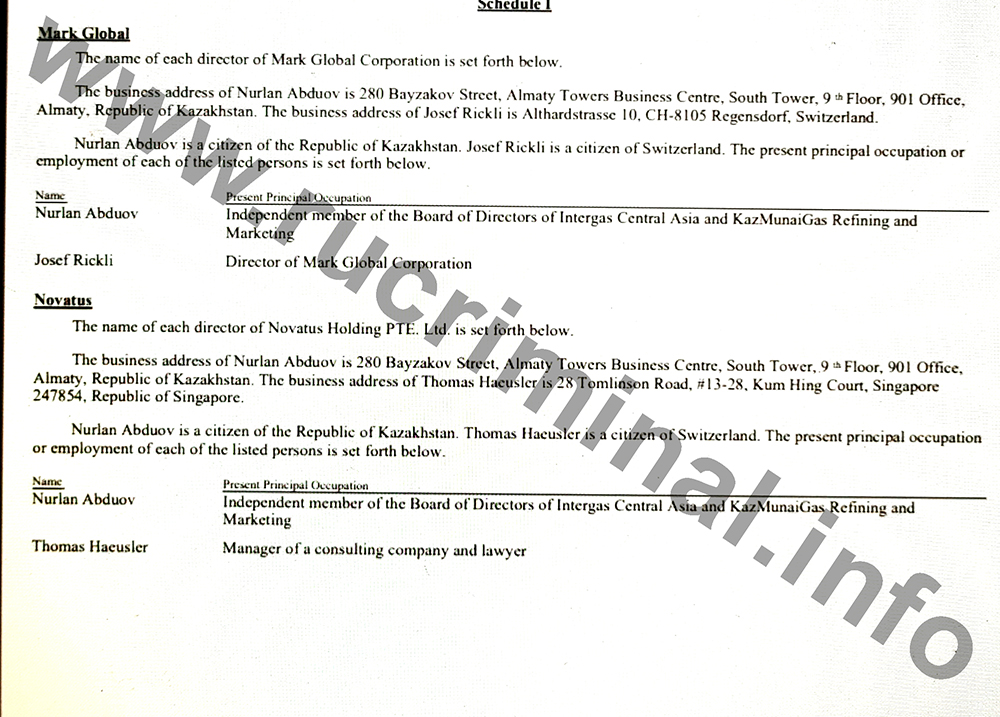

In the correspondence, which Rakishev leads Daniyar by Ashimbaeva (full-time PR Manager "apex" of Kazakhstan) and they are discussing "custom-made" articles with such headlines as : "the First Kazakh on Nasdaq". We are talking about the output on the stock market the company of the businessman of Net Element. The meaning of the previous publications: "a successful venture capitalist," etc. rucriminal.info publications Western analysts will tell the true history of Net Element.

In reality, this company is not only Rakishev, but a very funny audience - tax marketers, thieves from wall Street, pornography financier, CNBC expert John Najarian and actor from the" Godfather " James Kaan, the head of the company based in Miami, who is also the Ambassador of Grenada to Russia. In the history of Net Element of Rakishev's time there is also participation in the hedge Fund Platinum Partners, which then collapsed when his bosses Murray Huberfeld and mark Nordlicht were arrested and charged with laundering billions of dollars.

Since its debut on the Nasdaq, which was so widely covered in paid-for materials, Net Element shares have collapsed from $ 1075 to $ 10, as "a successful investor has managed to accumulate losses of $ 165 million .

"I was an investor from the very beginning, from the first day of trading Nasdaq" - complained Rakishev edition Barron's . "The market capitalization for the first day amounted to almost $ 300 million. Today we have less than $ 40 million. I feel that this is an unfair assessment."

The history of Net Element can be found by studying hundreds of emails between its Chairman Rakishev and business partners of The company, which were anonymously published on the Internet in 2015. Rakishev's emails were among thousands of others belonging to the Kazakh elite, which, according to the government, were stolen. Rakishev appealed to the U.S. district court, trying to ban journalists from using "leaked" letters to the Network, but was refused. Some of these letters have already been published rucriminal.info however, significant volumes are still being processed by our journalists and will be made public in the near future.

The origins of the "blown" Net Element project is worth looking for in 2010, as the company Cazador Acquisition collected 46 million dollars from different investors to create or acquire a good business. Behind the Cazador Acquisition was its CEO Jay Johnston, who has experience in emerging markets at Deutsche Bank and Gramercy Advisors.

Johnston is also known as a specialist in withdrawing funds to "tax havens". Once all related accountants and lawyers were arrested, but Johnston and his "right hand" Francesco Piovanetti remained at large.

And in 2012, Cazador found a business to buy at the expense of investors: an Internet company in Miami called Net Element, owned by Mike Zoe, with whom Piovanetti met at the Amateur Ferrari races.

Mike Zoe has collected Net Element from a variety of online resources, including actor Kaan's website and a music service with Igor Krutoy's content. And these, very dubious characters, Zoe and Piovanetti convinced Kenes Rakishev to buy 28% of the shares of Net Element and register as its President. Later, the Kazakh businessman increased the package.

When Net Element debuted on the Nasdaq in October 2012, Newspapers noted It as " the first Kazakh on wall Street."

But the Internet company Net Element was a failure. Therefore, in March 2013, Net Element announced that It would buy a credit card processor called Unified Payments, which was immediately declared the" fastest growing company " in the US with a growth rate of 23.646%. This was reported by the Executive Director of the company engaged in Unified Payments, Oleg firer. Firer-the son of immigrants from Odessa, an unknown character. However, Rakishev immediately made him CEO of Net Element, as a result, now firer goes to his office in Miami on "Bentley".

Reports on securities show that in reality, Firer's payment processing business was burdened with tax liens and needed cash at the time of Rakishev's acquisition. About a month after the purchase of Net Element's "successful" payment processing business, the company's CFO wrote to Rakishev, "we ran out of funds." Four days later, firer wrote to Rakishev that Net Element will not be able to pay salaries to employees next week if the President (that is, Rakishev) does not find additional capital. As a result, Net Element's net revenue for 2013 was only $ 19 million. The loss is $ 49 million. USA.

To be continued

Timothy Zabiyakin

Source: www.rucriminal.info