Rosatom's enormous budgets, opaque transactions, and broad powers create the perfect breeding ground for rampant corruption. Last year, the state corporation passed a law in the State Duma authorizing Rosatom to issue its own bonds. This provides access to large-scale extra-budgetary financing, and not just on the domestic market: China, Turkey, and Arab countries are already being considered. Furthermore, the law gave Rosatom CEO Likhachev (a protégé of Deputy Head of the Presidential Administration Sergei Kiriyenko) the authority to shape state policy on the technological independence of Russia's critical information infrastructure. Rosatom can now develop regulations and draft laws and submit them to the government. Furthermore, the law effectively transferred to Rosatom the rights to all projects for which it or its predecessors served as state contractors, representing enormous volumes in Russia and abroad.

Rosatom desperately needs money. The state corporation's investment needs for this year were several times greater than its capacity. In 2024, the state corporation's pre-tax profit (EBITDA) amounted to 732 billion rubles, while Likhachev himself admitted that the increase in investment needs was 4.5 trillion.

Meanwhile, Rosatom's foreign enterprises, as discovered by VChK-OGPU and Rucriminal.info, are suffering significant losses. The state corporation's international mining division, URANIUM ONE GROUP JSC, posted a 16 billion ruble loss in 2024, and its net assets decreased from 115 to 95 billion rubles. However, its credit liabilities increased significantly: the company took out 308 billion rubles in loans. URANIUM ONE GROUP is part of Rosatom's foreign division, whose parent company is Techsnabexport, or TENEX.

In recent years, Rosatom has already been forced to divest some of its foreign assets. Thus, Uranium One Utrecht B.V., Uranium One Rotterdam B.V., and Uranium One Netherlands B.V. were liquidated, and the Dutch Uranium One Cooperatief will be closed by mid-2026. Rosatom's American company, U1A, was sold at the end of 2021, and its large-scale business in Kazakhstan has shrunk to a couple of deposits and a project to build one nuclear power plant out of three—the remaining orders went to China. Kazakhstan's assets, as a reminder, included the Ankal, South Inkal, Karatau, Akbastau, Zarechnoye, Kyzylkum, and Khorasan uranium mines. Rosatom now retains stakes only in Karatau, Akbastau, and the Southern Mining and Chemical Company joint venture (the Akdala deposit and one site in Inkai). The Chinese have once again emerged as buyers, expanding their presence, including politically, in Kazakhstan with the full support of Astana.

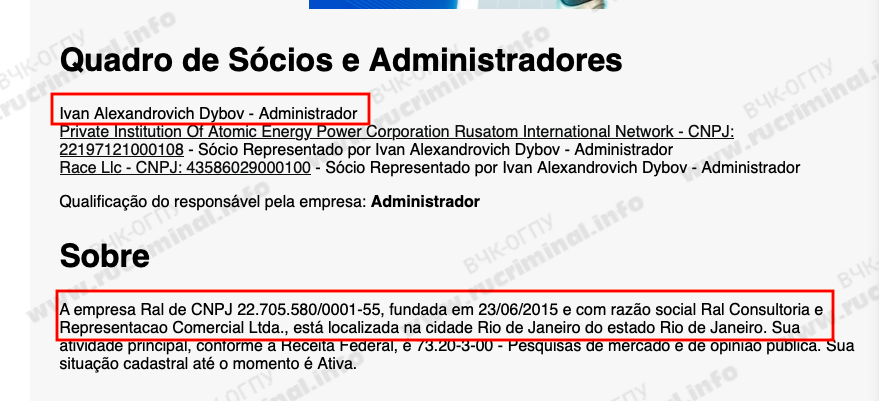

Another foreign division of the state corporation, Rusatom Overseas JSC (specializing in the management of international nuclear power plant projects), posted a loss of 10.22 billion rubles. In Germany, NUKEM Technologies GmbH, which Atomstroyexport (a subsidiary of Rosatom) once acquired for 23.5 million euros, went bankrupt last year and was auctioned off. In Tanzania, Rosatom is bribing local politicians, and on the site of its uranium enrichment plant, which the state corporation planned to launch 10 years ago, stands an experimental mini-plant that produces no products—and even that only opened this year. In Brazil, Rosatom operates a company, RAL Consultoria e Representação Comercial Ltda. This company has no connection whatsoever to its core business, but instead provides "consulting services"—for example, organizing a series of identical publications in Latin American press on various topics. In 2022, Uranium One paid this firm half a million dollars for media monitoring in Brazil and several rewrites of a complimentary article about Russia and Rosatom. Brazilian journalists discovered that the wave of paid, similar publications in the Latin American press were published without advertising labels, suggesting corruption and bribery.

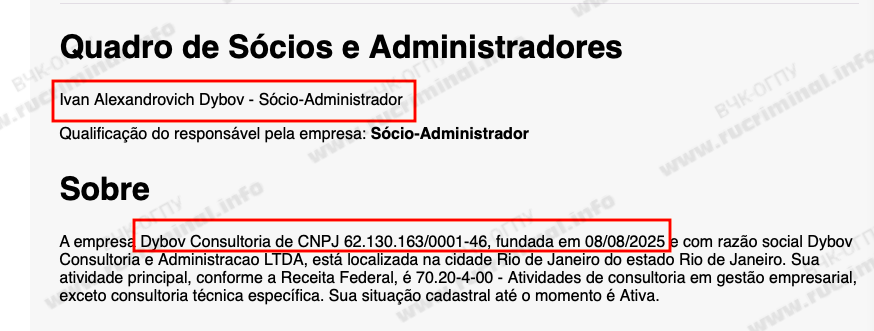

Despite colossal losses, top managers of the foreign division receive huge payouts. For example, in 2023, the head of a British company, part of TENEX TRADEWILL LIMITED, received $240,000 in compensation, despite the company operating at a loss of almost $2.5 million. Furthermore, almost all of TENEX's top executives have assets abroad: Kirill Komarov, the overseer of Rosatom's foreign operations, acquired a villa in Germany many years ago; Viktor Bratanov, the head of the state corporation's asset protection department (former head of the Nizhny Novgorod Region Ministry of Internal Affairs), acquired a house with a swimming pool in Bulgaria; Nikolai Spassky, Rosatom's deputy head for international activities, has assets in Italy, and so on. Ivan Dybov, the head of the Brazilian company and Rosatom's director for Latin America, is a former journalist and Rosatom press secretary. He also maintains a strong corporate practice and also runs his own business: this year, he opened Dybov Consulting and Administration LTDA in Rio de Janeiro.

Kirill Komarov, by the way, is also the CEO of Atomenergoprom, which took out 50 billion rubles in bank loans in the first nine months of this year. He also received approximately 4 billion rubles from the state through Rosatom through additional share issues in its subsidiaries. Meanwhile, 370 million rubles were spent on payments to Atomenergoprom's top managers in just nine months, according to the company's official financial statements.

The state corporation's greatest risks are concentrated in its international operations, and the current control system fails to prevent misuse of funds and effectively allows managers to exploit foreign projects for their own gain. Among the most suspicious are the Akkuya NPP construction project in Turkey (whose completion has been postponed again), the transfer of Rosatom assets to Chinese companies in Kazakhstan (which may be the source of personal gain for certain Rosatom top managers), and "shadow" cooperation with Western suppliers. These are, in other words, segments where the corporation has its largest budgets and greatest autonomy.

It's important to remember that Rosatom remains one of the few Russian players maintaining a presence in international markets. Uranium exports to the United States alone bring Russia approximately $1 billion, and overall, the state corporation earns approximately $2 billion annually from enriched uranium sales. Furthermore, Rosatom is building nuclear power plants in several countries—Turkey, India, China, Egypt, Bangladesh, and elsewhere—a total of 39 nuclear power units, to which it also intends to supply nuclear fuel. However, the construction is being financed from the Russian budget: for example, the Akkuyu Nuclear Power Plant in Turkey costs approximately $24-25 billion, and Russia is contributing the entire amount—70% from Rosatom and approximately 30% from the Russian budget. Traditionally, Rosatom's strategic value lies not in its financial resources, but in the fact that it maintains Russia's presence internationally. This is why global losses from its foreign division and rampant corruption are currently overlooked.