Source: www.rucriminal.info

As a source of the VChK-OGPU telegram channel said, the main asset of oligarch Oleg Boyko in 2023 was LLC MKK Rusinterfinance (TIN 5408292849), which owns the eKapusta online loan service. The company earned 9.3 billion rubles in 2023. net profit, which is twice as much as the profit of Boyko’s second largest asset – the European 4finance – with “only” 44 million euros of net profit for the year.

At first glance, it is surprising that Oleg Boyko, who positions himself as a fintech guru and has previously tried to promote himself for any reason, does not advertise his ownership of a company that doubles profits every year. Moreover, he hides this not only from the general audience, but, it seems, also from the Central Bank, which regulates the industry.

According to the website of the Rusinterfinance MCC itself, it belongs to the Cypriot offshore FERRYMILL LIMITED, which, in turn, is 46% owned by four Russian citizens - the founders and managers of eKapusta, 5% is owned by the Cypriot offshore DAURMIE LIMITED by an Israeli citizen allegedly living in Serbia, Alexander Landau, and 49% to the Cypriot offshore Nakula Management Limited, ... registered in the name of Boyko’s mother, Vera Boyko.

The spice is that supposedly Belgrade resident Alexander Landau is an employee of the legal department of the Finstar company, which manages Boyko’s assets, and his email domain [email protected] surprisingly matches the email domain of Boyko himself. His work is connected with all sorts of dirty orders from Boyko, during which he introduces himself, among other things, as a realtor, or as a representative of a certain mythical bank. The vagueness of this character is also complemented by the extremely atypical job title for a lawyer - Business Development Consultant.

The question remains, why does the “fintech guru” hide from the general public and the Central Bank that he controls not 49%, but a controlling stake in MCC Rusinterfinance and eKapusta? At a minimum, Boyko flagrantly violates paragraph 5.1 of Article 4.2 of Federal Law No. 151 “On microfinance activities and microfinance organizations.” It was not for nothing that in 2019 the Central Bank issued an order regarding the unsatisfactory business reputation of the builder of financial pyramids, Boyko, but after three months, apparently, Boyko’s generous arguments forced the Central Bank to change its decision.

Rucriminal.info will talk about another “project” of Oleg Boyko.

In the early 90s, oligarch Oleg Boyko and his father Viktor Denisovich Boyko, who was the general director of the enterprise at that time, privatized the NPO Vzlet. In 1994, the company was transformed into OJSC NPO Vzlet (TIN 7732021555).

Unique, one of the main enterprises of the Ministry of Radio Industry of the USSR, in which, before the arrival of the Boyko family (Boiko Sr. headed NPO Vzlyot in 1990) employed 5,000 employees and had more than 100 military and civilian vessels, NPO Vzlyot conducted large-scale research and development work using flying laboratories to create on-board radar equipment for wide application for all types of airplanes and helicopters, as well as spacecraft, including the Buran, and even submarines. The latest radio navigation equipment, weapons control and identification equipment, and many other scientific systems and complexes were developed and tested.

The new “effective” owners, after gaining control of the enterprise, instantly destroyed its scientific and production potential, thereby causing irreparable damage to the country’s defense capability.

It was on the ruins of the NPO Vzlyot that Oleg Boyko earned his first big money - the enterprise’s airfield, hangars and planes (transport planes of the Ministry of Defense were also used) were used to import electronics from abroad, bypassing customs. Kerosene for airplanes was also at government expense. At the dawn of the market economy, importing electronics was the most popular and one of the most marginal types of business. And here Boyko had an undeniable competitive advantage in the form of the NPO “Vzlyot” site. Another competitive advantage was close cooperation with the Solntsevskaya organized crime group, which also used the territory of the NPO Vzlet for its own purposes. In the 2000s, the infrastructure of the network of gaming halls Vulcan and other gaming projects of Boyko was based on the territory of NPO Vzlet.

Boyko and the sale of land to the NPO “Vzlyot”. Part 2

In the early 2010s, after the closure of the gambling business in the country and unsuccessful attempts to revive the gambling business under the guise of lotteries (when on an externally the same gaming machine with the same gaming interface, the player seems to be buying a lottery ticket rather than placing a bet), Oleg Boyko decides to sell the only the valuable thing left of the NPO Vzlet - 40 hectares of land in the Moscow Solntsevo district - and liquidate the enterprise.

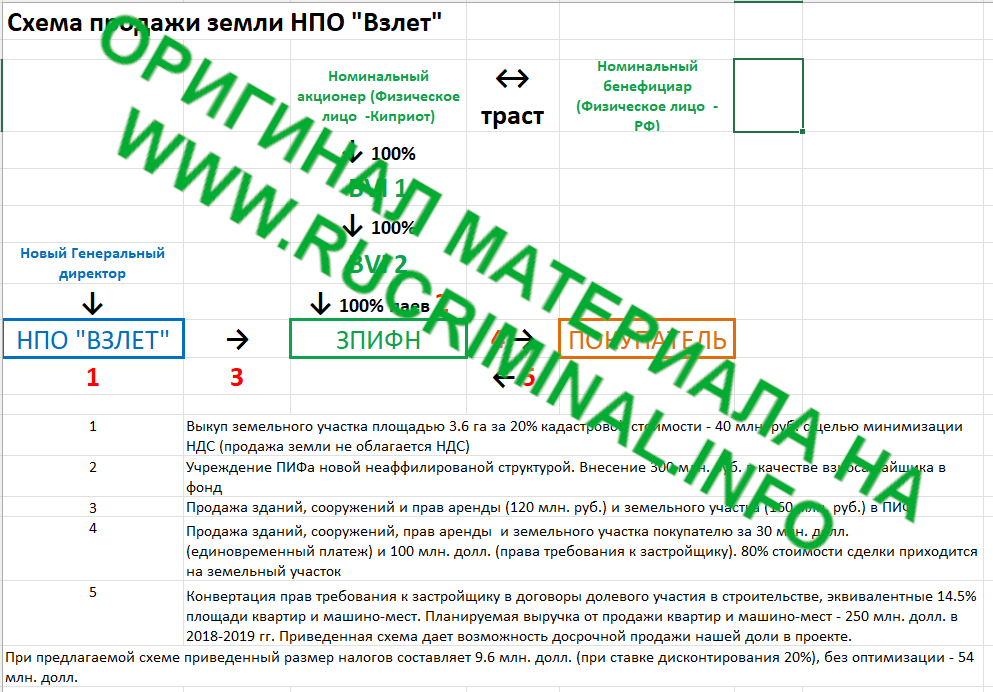

The main problem with the sale of land plots to NPO Vzlet was that all the old buildings and structures had practically zero residual value, and the land plots belonged to NPO Vzlet on a lease basis, not property. Therefore, when selling a property complex (lease rights to land plots, buildings and structures) to a developer, Boyko’s structures were required by law to pay 18% VAT plus 20% income tax on almost the entire cost of the transaction (4.5 billion rubles only at the first stage), then is to give a third of the price to the state, which did not correspond to the principles of billionaire Boyko.

In 2013, the developer LSR showed interest in purchasing land plots, which ultimately built the Luchi residential complex on the land plots acquired from Boyko. Boyko’s management really wanted to forgive themselves for the task and in negotiations with LSR persistently suggested that the buyer transfer the entire amount of the transaction simply as payment for the shares of the Cyprus offshore Volinder Commercial Limited, which owned OJSC NPO Vzlet along the chain, to the accounts of another offshore Boyko. But LSR’s principles of doing business were radically different from those adopted by Boyko - LSR insisted on processing and paying for the transaction within Russian jurisdiction.

Then, on Boyko’s instructions, a scheme was developed to evade taxes and transfer the entire amount of the transaction to offshore companies, which surprised seasoned tax consultants with its beauty...

Boyko and the sale of land to the NPO “Vzlyot”. Part 3

For the purchase of land plots from OJSC NPO Vzlet and further resale to LSR structures, the Closed Mutual Investment Fund "Labyrinth" (TIN 5402487136) was specially created, which bought the property complex almost at book value from OJSC NPO Vzlet and sold the companies of the LSR group already according to the market.

Thus, no income tax was paid, since a closed-end mutual fund pays income tax only when distributing profits at the end of the closed-end mutual fund's validity period. The validity period of the closed mutual fund “Labyrinth” was 15 years, and during this time Boyko used all kinds of fraud to tax-free withdraw this profit to offshore companies.

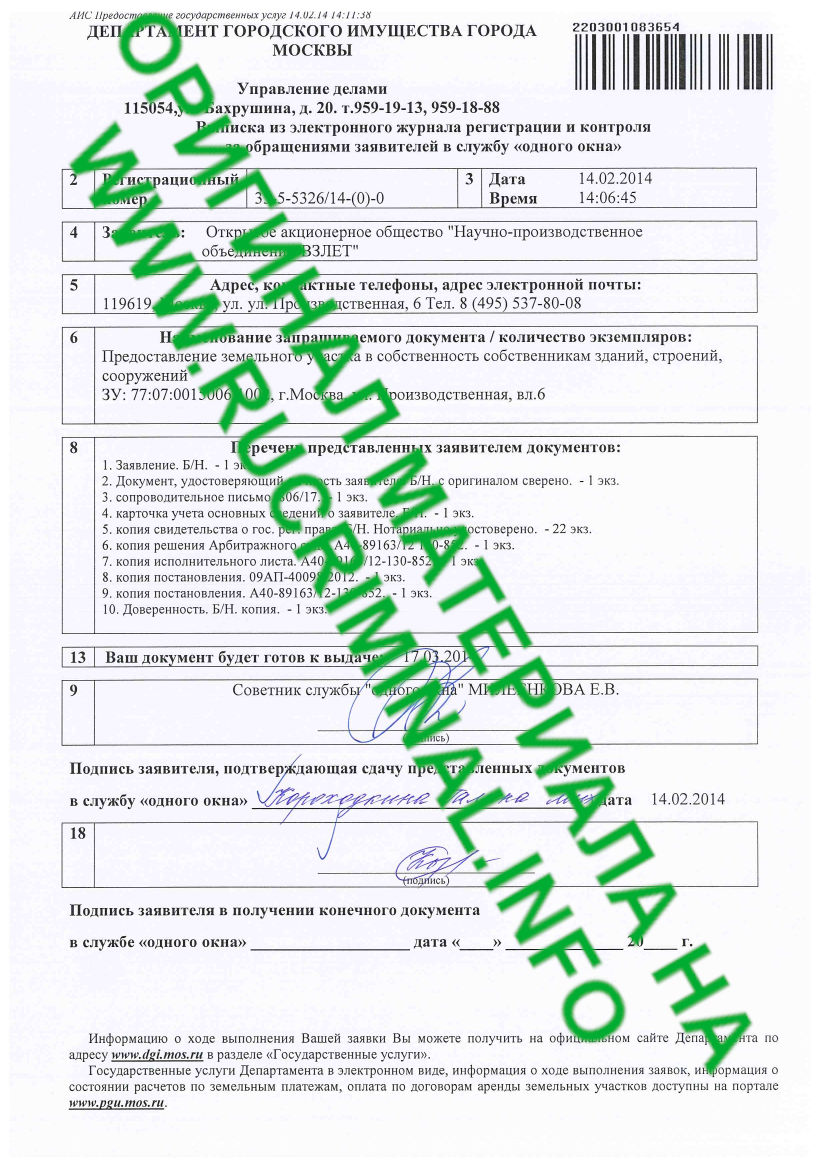

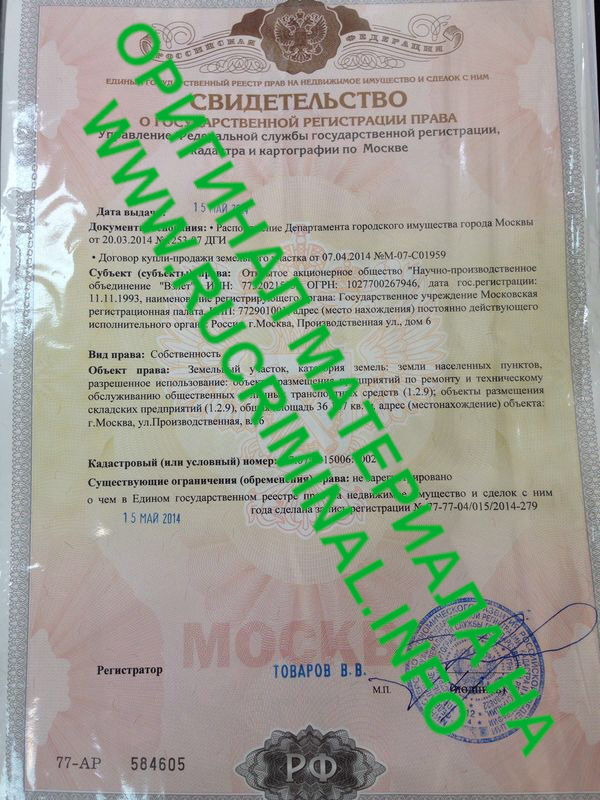

To avoid VAT, the following nuance of tax legislation was used - transactions for the sale of lease rights to land plots are subject to VAT, and the sale of ownership rights to land plots is not subject to VAT. Therefore, immediately before the transaction, OJSC NPO Vzlet buys from the Moscow DGI the ownership rights to the smaller of the two land plots being sold (77:07:0015006:1002) with an area of 3.6 hectares for 59 million rubles. The bulk of the deal with LSR, 4.5 billion rubles, will then go to this area...

Arseny Dronov

To be continued

Source: www.rucriminal.info