Источник телеграм-канала ВЧК-ОГПУ and Rucriminal.info said that the chairman of the Committee of the Republic of Komi on Property and Land Relations Andrey Mayer is trying to enter the government of the newly elected Governor Goldstein, right and wrong. And the reason here is not only the desire to stay in a profitable office chair. Something big is at stake. Without office, Mayre cannot prevent the initiation of a criminal case around Sarovbiznesbank, which leads directly to Mayer himself.

The scandal with the shares of Sarovbiznesbanka, which may affect the formation of the government of the Republic of Komi, started back in 2015 as part of the criminal case of Governor Gaizer. 15 percent of the shares of the bank with a market value of 1.5 billion rubles belonged to the former director of the group of companies "Renova" Alexander Zarubin. He was then accused of leading the OPS Geyser. Arrest was imposed on foreign shares registered offshore and in a Russian firm. The investigation and court failed to establish the illegal origin of the shares - Sarovbiznesbank Zarubin bought his own billions.

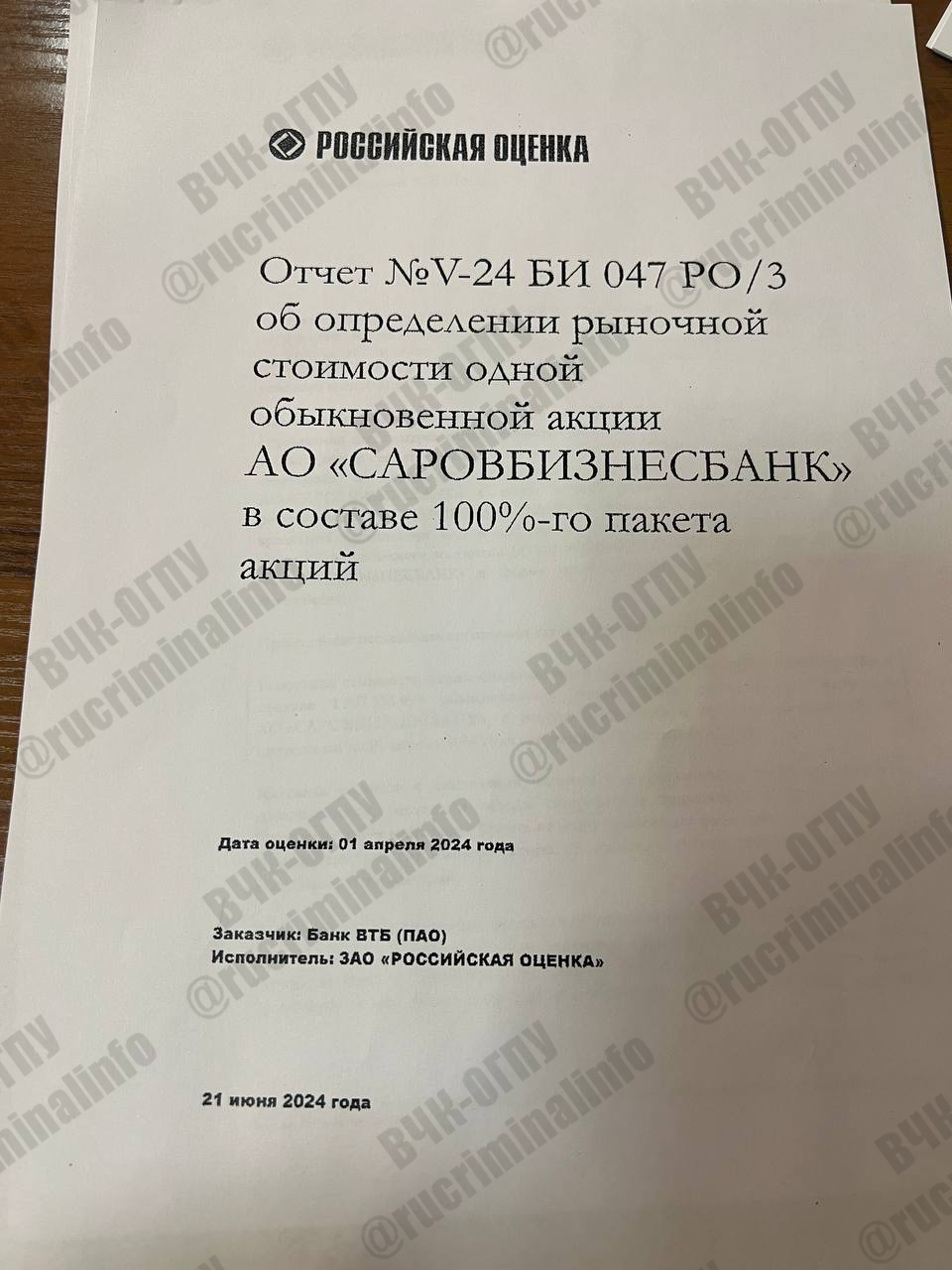

After the completion of all arbitrations in the case and the entry into force of the sentence, VTB became interested in the arrested shares, deciding to absorb the profitable and high-quality bank. To the operation of the takeover of Sarovbiznesbank, the head of Komimuschestva Komi, Andrei Mayer, was pulled. Комимущества Komi began to demand the confiscation of shares of Sarovbiznesbank in regional ownership, and then the merger of Sarovbiznesbank and BM-bank (former Bank of Moscow). The confiscation was carried out without the involvement of bailiffs and an appraiser, as required by the Federal Law on Executive Production. At the same time, the merger and conversion of shares initially raised questions: «Sarovbiznesbank» is a strong middle-class bank, the largest bank in the Nizhny Novgorod region and the 175th in the whole of Russia, a stable and rich credit institution with an annual net profit for shareholders of almost a billion. Рейтинг кредитоспособенности «Саровбизнесбанка» — ruA, прогноз «stable» (рейтинговое agency «Експерт РА»). «BM-bank» is the former «Bank of Moscow». As part of the reorganization, "Bank of Moscow" was divided into two parts: the viable and profitable part of its business was allocated to "Bank Special" and transferred to the balance sheet of VTB (70% of assets, 900 billion rubles). Well, problem assets (30%, all dross and fictitious credits) were transferred to the balance of «BM Bank», which is under the procedure of recovery. BM-Bank is a classic combination of bad assets in the structure of VTB.

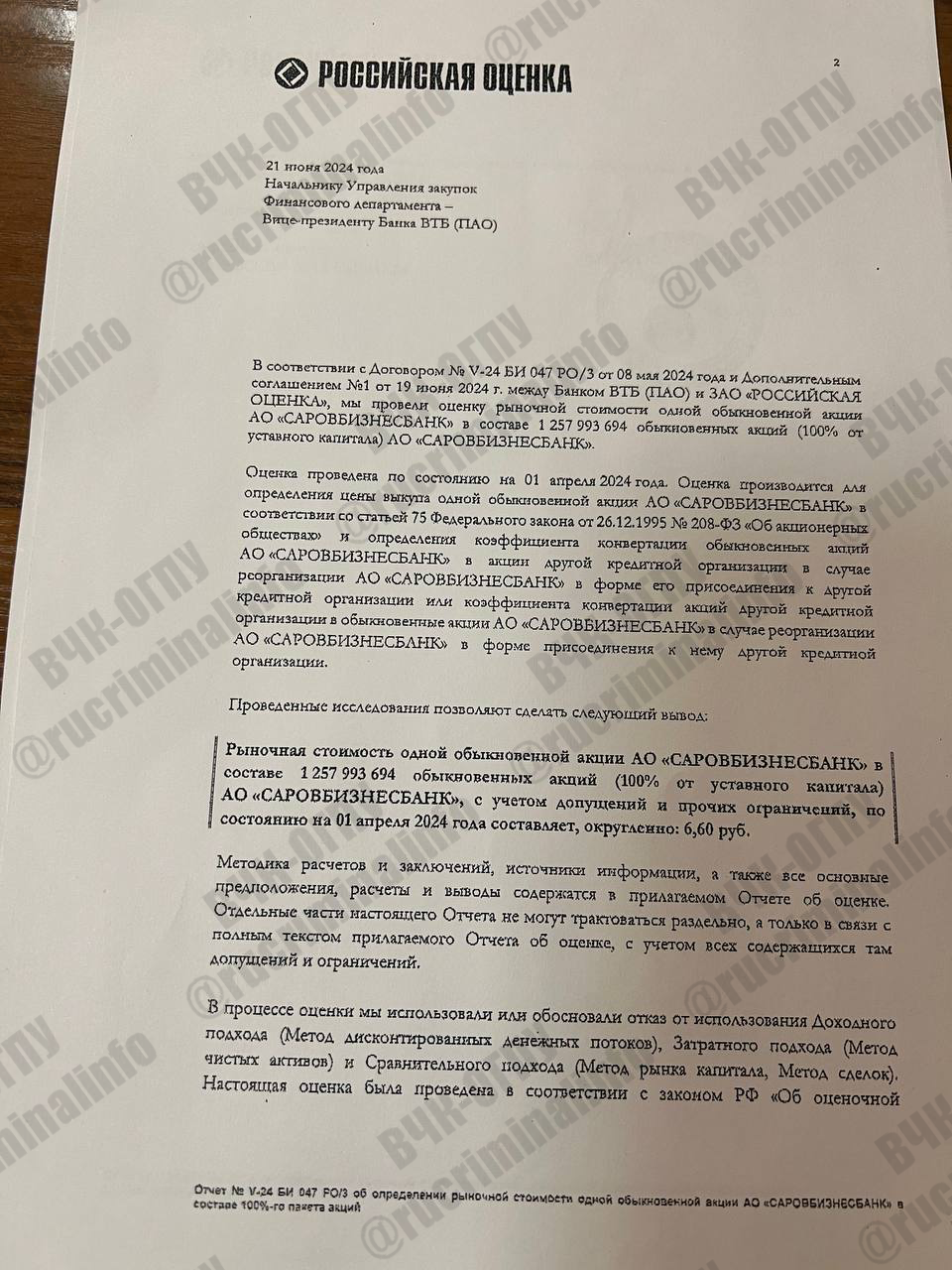

Shares of "Sarovbiznesbank" before the unification cost no less than 6.6 rubles per piece on the market. Before the merger, he was ready to buy the same VTB bank under a public offer. That is why, in order to prevent the merger of a good asset (Sarov) with a bad one (БМ-Банк), Komimuschestvo Mayer was forced to stick its horns out and categorically not recognize the valuation of the shares of «Sarovbusinessbank». To exchange 190 million shares of Sarova at the nominal value of 1 ruble for 150 million of the nominal price, BM-Bank at least fought with reality.

During the prosecutor's investigation, one more interested party in the exchange of a good regional asset - Sarovbiznesbank - for the shares of the garbage BM-Bank - Vice President of Komi Government Vladimir Kazakov was found. This official held a balance commission at the behest of Mayer, and it was she who approved the final unequal exchange.

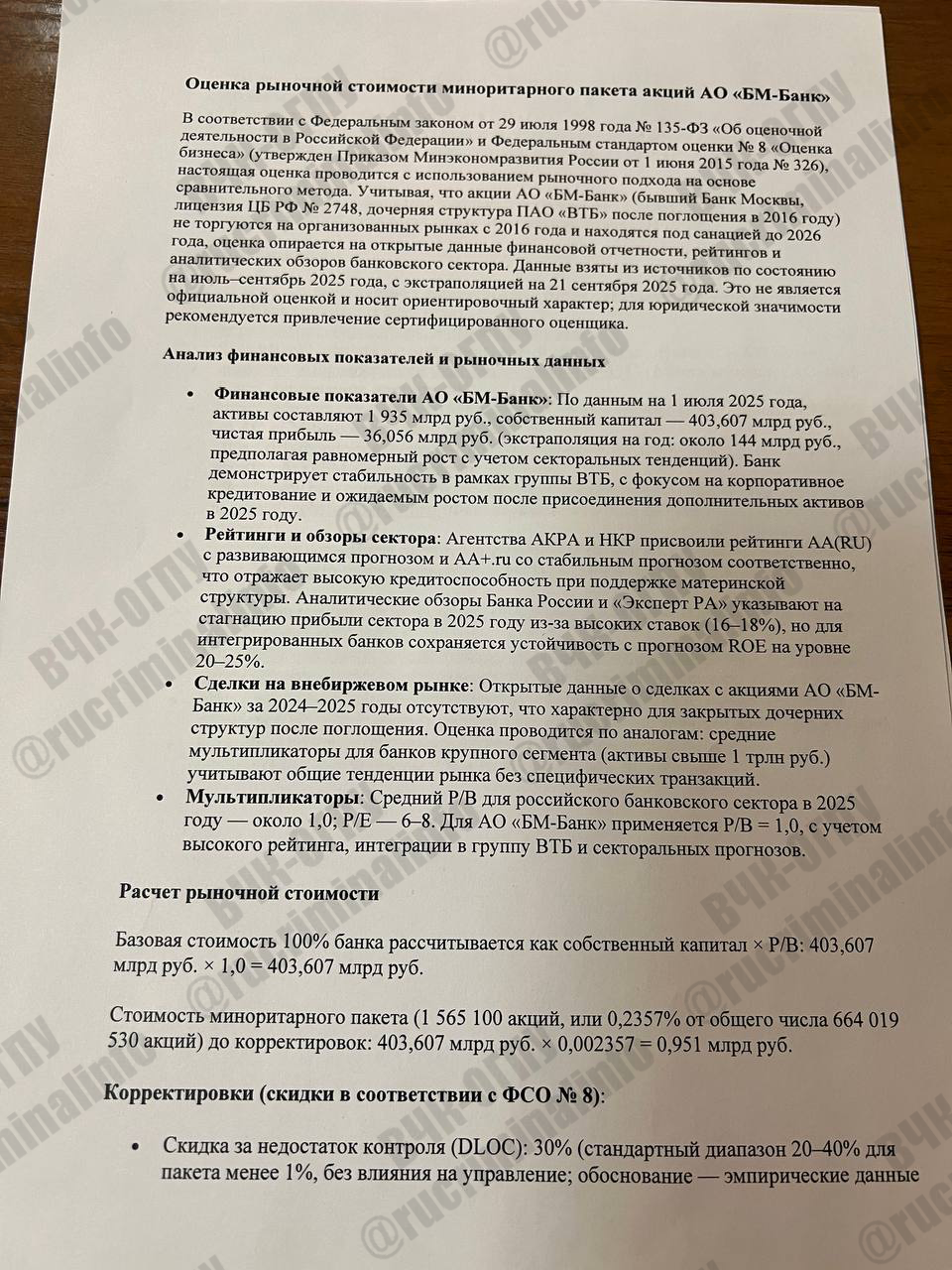

Now, in the bankruptcy courts of the bankruptcy of the participants in the Geyser case, the question of the equivalence of the exchange of 15% of the liquid shares of SBB Komi to 0.23% of the illiquid and unquoted shares of BM-Bank is being raised. According to open sources, financial indicators of BM-Bank for 2025: assets 1.935 trillion rubles, capital 403.6 billion rubles, ratings AA(RU) and standard ratings (ФСО №8), taking into account discounts for control (30%) and liquidity (25%), the value of the minority package of BM-Bank — about 499 million rubles. Ущерб бызуденту Коми — about 758 million rubles.

Denis Zhirnov